Irs rmd calculator 2021

Get a free bonus retirement guide. Required Minimum Distribution Calculator.

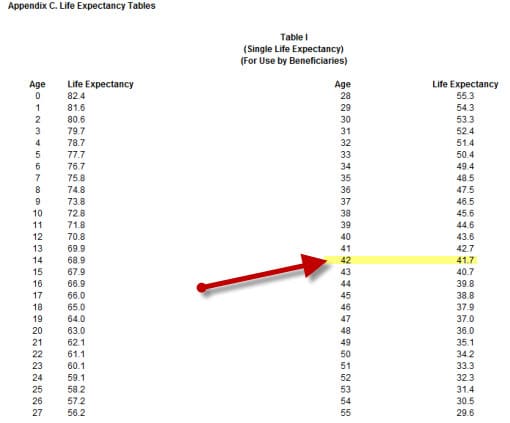

Rmd Tables

Ad Click here for some simple facts about paying RMDs and managing retirement withdrawals.

. The SECURE Act of 2019 changed the age that RMDs must begin. RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. Once you determine a separate required minimum distribution from each of your traditional IRAs you can total these minimum amounts and take them from any one or more of your traditional.

Required Minimum Distribution Calculator. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. How is my RMD calculated.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. We will automatically calculate your distribution to help ensure your RMD is taken each year avoiding potential additional taxes. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705.

The distributions are required. Under the old table the divisor was 229. Therefore your first RMD.

The service also helps ensure that you do not over- or under. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020.

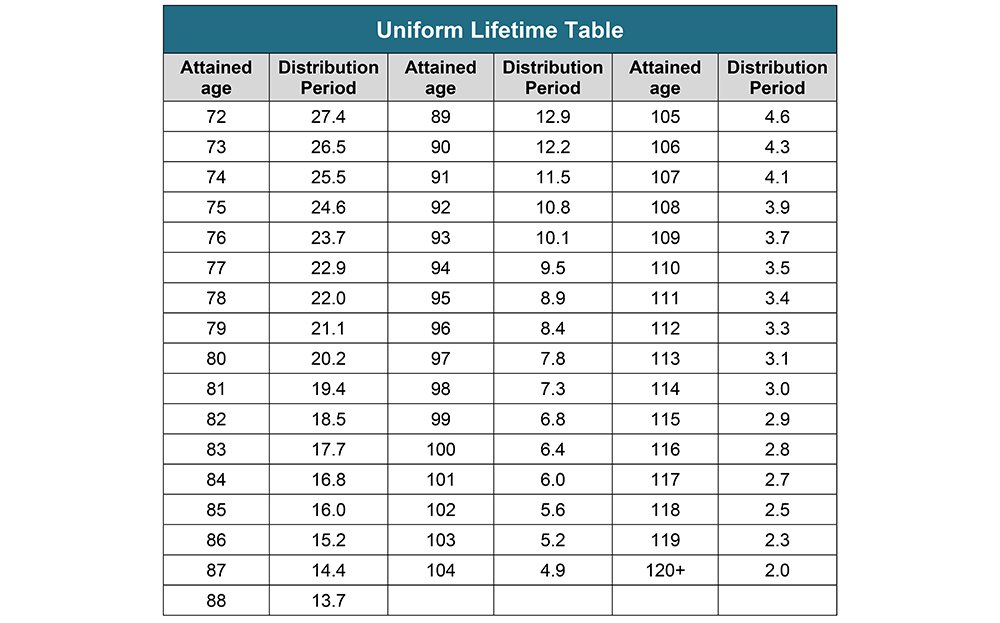

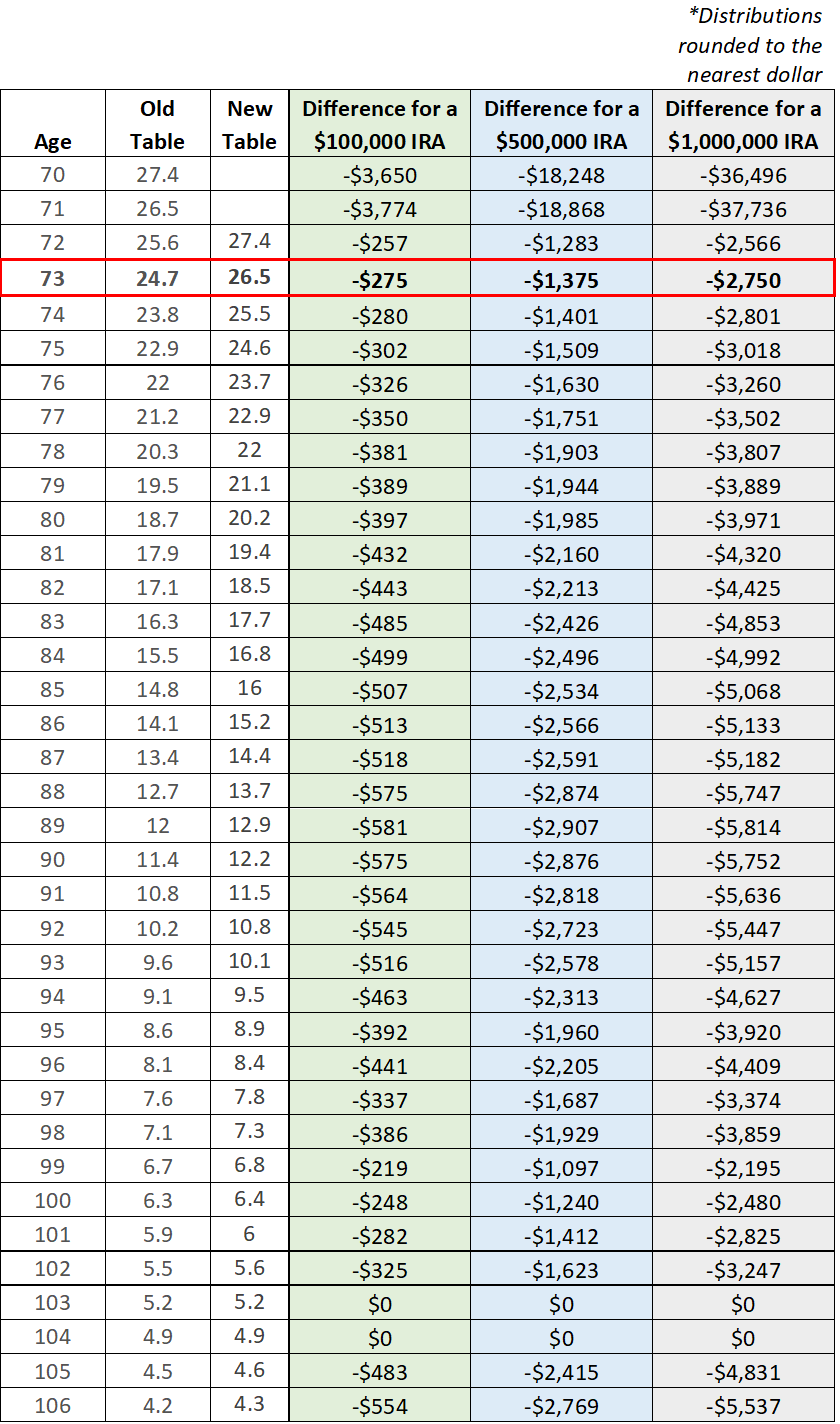

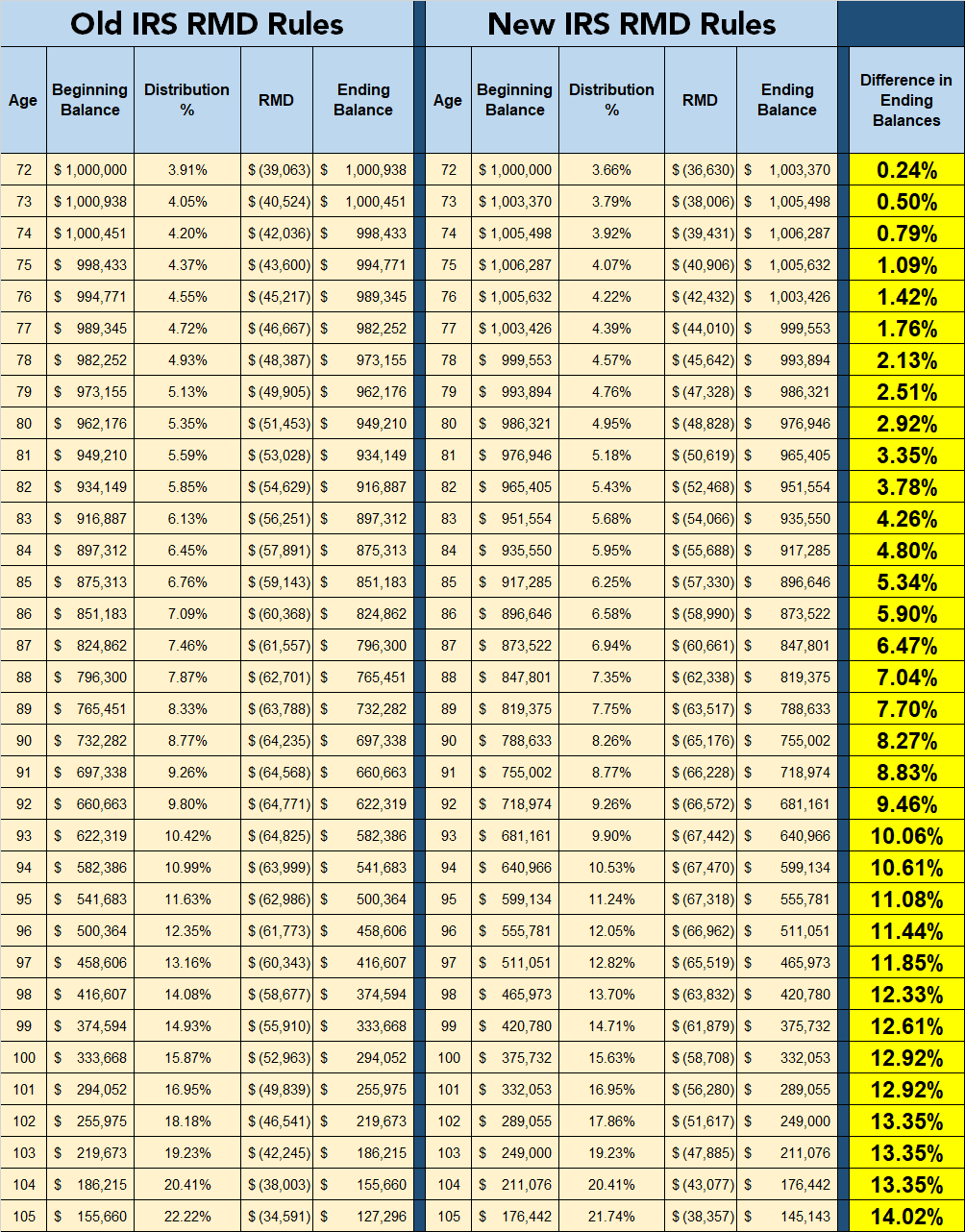

For an IRA with a balance of 700000 on 12312021 the difference in RMD is 28455 new table versus 30568 old table. The distribution period or life expectancy also decreases each year so your RMDs will. IRA Required Minimum Distribution RMD Table for 2022.

Use this worksheet for 2021. 13 Retirement Investment Blunders to Avoid. Therefore Joe must take out at least 495050 this year 100000 divided by 202.

Account balance as of December 31 2021. On November 12 2020 the Federal Register released a Final Regulation providing guidance on the life expectancy and Required Minimum Distribution. 2022 Retirement RMD Calculator Important.

Then you must track down your age on the. Distributions are Required to Start When You Turn a Certain Age. Your life expectancy factor is taken from the IRS.

To calculate the required minimum distributions you must first check the IRS Publication 590 which has the RMD table. Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA. This calculator has been updated for the.

If you were born. Ad The IRS Requires You Withdraw an Annual Minimum Amount From Certain Retirement Accounts. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually.

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Required Minimum Distributions Tax Diversification

Required Minimum Distributions Update 2021 Fcmm Benefits Retirement

Calculating Required Minimum Distributions

Mandatory Ira Withdrawals The Elder Law Firm Of Robert Clofine

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Distribution Calculator Estimate Minimum Amount

Your Search For The New Life Expectancy Tables Is Over Ascensus

What Do The New Irs Life Expectancy Tables Mean To You Glassman Wealth Services

Rmd Table Rules Requirements By Account Type

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Where Are Those New Rmd Tables For 2022

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Irs Change Will Decrease Rmds Beginning In 2022 Level Financial Advisors

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Tables

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts